How a Payroll Company Optimises Payroll Management and Enhances Compliance

Payroll Companies play a pivotal role in the smooth operation of an enterprise's payroll process. This article provides an in-depth look into the various departments within a payroll bureau, each specialising in different aspects of the payroll process. From payroll operations to software integration services, learn how each department works in unison to ensure accurate and timely payroll processing. The article explores how outsourcing your payroll to a Bureau can save your time, ensure compliance with payroll regulations, and provide enhanced security for your employee's data.

Table of contents

I. Implementations

II. Payroll and Pensions

III. BACS Payments

IV. Software Integration Services

V. Security

VI. Client Services

Payroll Implementation

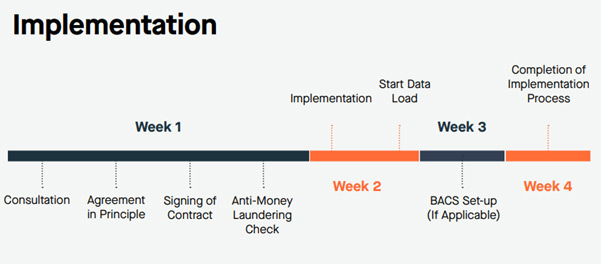

Once your initial consultation with your selected payroll bureau is complete, you’ll receive a contract/SLA to review. It’s crucial that all team members involved in managing your payroll read this document thoroughly. Early on, identify and address any potential issues to gain a comprehensive understanding of the established processes. This will help you anticipate any problems that might arise or adjustments you might need to make to the payroll at a later stage.

For instance, if a payment is late, can your provider facilitate CHAPS or faster payments? Once you’ve reviewed and confirmed the contract’s contents, the implementation phase will commence. This involves uploading your employees’ data into the payroll software or portal. The implementations department ensures that this process remains secure and accurate and helps implement your payroll safely and on time.

During the implementation process you will need to decide what your payment process will be regarding salaries and PAYE. Is your chosen provider BACS approved? Or will you need to maintain control of payments in-house? Typically, payments are managed through the Banker’s Automated Clearing System (BACS) through Bureaus provided your business is eligible.

Pay Check’s Implementation Timeline

BACS Payments

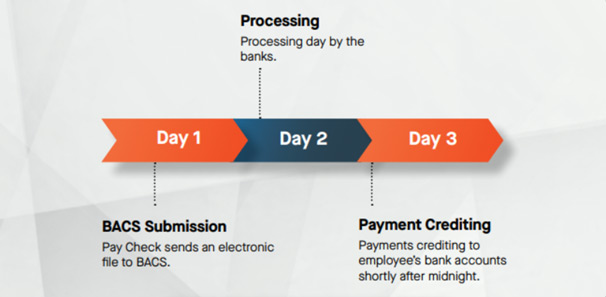

BACS payments are electronic payments made from one bank to another. As a BACS-Approved Bureau, we can make third-party BACS payments on your behalf once the file has been approved. BACS payments are highly secure, and for peace of mind, your Bureau does not have access to your firm's bank account. If you are eligible to make BACS payments, there are certain considerations to be made when applying for a BACS user number. Your bank will ask you for a suggested credit limit, when doing this don’t just consider your monthly credit amount but include special annual events such as bonuses as a part of your annual BACS credit to avoid the risk of BACS rejections.

In addition, we can facilitate payments of PAYE deductions to HMRC or Pension Contributions on your behalf using BACS, ensuring a hassle-free experience for you. This comprehensive solution is designed to meet all your payroll needs.

Here’s some insight to what the BACS payment processing timeline looks like

Software Integration Services

Software Integration Services when utilised can simplify the payroll process by merging data from different software's, such as HR systems. This service removes the duplication of input with bespoke files exported from your Time and Attendance and/or HR systems, and via API file upload or data transfer.

The online portal, which can be tailored to align with your company’s unique requirements, allows you to streamline your payroll management with its user-friendly platform; centralising all your data for accurate and timely payroll. This not only enhances the efficiency of your payroll process but also guarantees precision and timeliness.

Pay Check can create customised journals for time-savings by simplifying the reporting process. The portal is compatible with the majority of account packages such as Xero, QuickBooks, and more, offering you flexibility and ease of use.

One client said, "There are various new regulatory hurdles to starting a payroll, but the company uses many robust automated tools to implement its processes, and I got through it quite quickly."

Additional Software Services

Payroll Bureaus already have robust security measures in place so we can best protect your sensitive information and data. Employees undergo training in digital safety and GDPR compliance. This training is regularly reviewed and updated, ensuring they have the latest knowledge to safeguard your data. However, additional services can be offered to enhance your overall data security such as Two Factor Authentication and Single Sign-On. 2FA (Two Factor Authentication) is becoming standard practice for businesses wanting to safeguard their information. 2FA provides the user with a one-time passcode when logging in. Other methods, such as SSO (Single Sign-On), issues the user with one set of credentials to be able to access multiple related software programs.

Client Services

Client Services plays a crucial role in enhancing our client's payroll services. Our approach is proactive, ensuring that clients receive regular newsletters and updates about their payroll process. We actively reach out to clients to identify and implement improvements in their payroll experience. Each client is assigned a dedicated payroll manager who not only oversees their payroll but also initiates regular check-ins and is readily available for any questions. This proactive communication ensures clients are always informed and any issues are swiftly addressed. Excellent communication and a mutual understanding of the company’s payroll processes are key to facilitating company growth and strengthening our client relationships.

Conclusion

All our departments come together to process your payroll efficiently. Outsourcing your payroll to a payroll bureau can save time on administration and ensures effortless assurance with GDPR compliance every step of the way when comparison to companies who manage payroll in-house. Additional benefits include, the flexibly of software integrations with the payroll portal, a dedicated contact for all your payroll queries, and enhanced security through advanced security measures that safeguard your company’s payroll data. Outsourcing to a payroll bureau such as Pay Check can help your payroll management run smoothly, saving you time and the headache of doing payroll in-house for all your employees.

Isabella Zermani

Pay Check

paycheck@paycheck.co.uk

+44 (0) 20 7866 4600